-

What Are My Rights After a Dump Truck Accident in North Carolina?

April 10, 2025

-

What Are My Rights After a Rear-End Collision in South Carolina?

April 9, 2025 -

What Is the Personal Injury Statute of Limitations in North Carolina?

April 9, 2025 -

What Happens if Bad Weather Causes a Car Accident in Charlotte, NC?

April 9, 2025 -

How to Obtain Truck Accident Compensation

March 26, 2025 -

Rear-End Car Accidents in Charlotte: Understanding Your Legal Options

February 7, 2025 -

How Fault is Determined in a Car Accident in North Carolina

February 7, 2025 -

How Much Is My Rock Hill Personal Injury Case Worth?

September 27, 2024 -

How Much Does It Cost to Hire a Personal Injury Lawyer in Rock Hill?

September 27, 2024 -

How Do You Know If You Have a Personal Injury Case in Rock Hill, South Carolina?

September 27, 2024 -

How Much Compensation Can I Get from a Car Accident in Rock Hill?

September 27, 2024 -

How Do You Determine Fault in a Rock Hill Car Accident?

September 27, 2024 -

Can I Sue if I Was in a Car Accident in Rock Hill SC?

September 27, 2024 -

What to Do If You Are in a Truck Accident in Rock Hill, SC

September 27, 2024 -

What to Do If You Are in a Car Accident in Rock Hill, SC

September 27, 2024 -

What Is My Trucking Case Worth in Rock Hill?

September 27, 2024 -

What to Do If You’re Involved in a Rental Car Accident in Rock Hill

September 23, 2024 -

Why You Should Hire a Rock Hill Personal Injury Lawyer

September 23, 2024 -

Should I Have a Dashcam in My Car in Rock Hill?

September 23, 2024 -

What to Do if You’re an Injured Passenger in a Car Accident in Rock Hill, SC?

September 23, 2024 -

Does Insurance Cover Uber/Lyft Accidents in Rock Hill, SC?

September 23, 2024 -

What Is My Trucking Case Worth?

June 19, 2024 -

What to Expect During a Deposition

June 19, 2024 -

Understanding the Statute of Limitations for Car Accidents in North and South Carolina

June 11, 2024 -

How Social Media Can Make or Break Your Case

June 10, 2024 -

What Not to Tell a Claims Adjuster: A Guide to Protecting Your Rights

May 1, 2024 -

Understanding Punitive and Compensatory Damages: A Guide to Your Legal Rights

May 1, 2024 -

The Worst Thing You Can Do to Ruin Your Car Accident Injury Case

May 1, 2024 -

How Long Does an Accident Claim Take?

May 1, 2024 -

Understanding the Process: Consulting an Accident and Injury Attorney

May 1, 2024 -

Should You Seek Medical Attention After an Accident?

May 1, 2024 -

What to Do If You’re Injured as a Passenger in a Car Accident in Charlotte

March 29, 2024 -

Can I Recover Compensation for Motorcycle Accident Injuries if I Was Not Wearing a Helmet in Charlotte?

March 26, 2024 -

Understanding Contributory Negligence in North Carolina

March 26, 2024 -

How To Navigate Medical Bills After an Accident

March 26, 2024 -

Can I Sue for A Dog Bite in Charlotte, NC?

March 26, 2024 -

Filing a Personal Injury Claim for Your Child in Charlotte

March 26, 2024 -

How to Get Reimbursed for Lost Wages After a Car Accident in Charlotte, North Carolina?

March 26, 2024 -

Does Insurance Cover an Uber or Lyft Accident in Charlotte, NC?

March 26, 2024 -

What do I do if someone else’s road rage caused my car accident?

May 14, 2022 -

The dangers of high-speed car accidents.

May 14, 2022 -

Will I have to go to court if I file a lawsuit for a car accident?

May 14, 2022 -

Does pain and suffering include my medical bills?

May 14, 2022 -

What is the statute of limitations for filing a wrongful death case in South Carolina?

May 14, 2022 -

How is negligence proved in a wrongful death case?

May 14, 2022 -

What type of compensation is available for a wrongful death case in South Carolina?

May 14, 2022 -

Do I Have a Case if I Was in a No-Contact Accident Due to a Car Forcing My Motorcycle Off the Road?

May 14, 2022 -

What does South Carolina consider catastrophic injury?

May 14, 2022 -

How does a seatbelt prevent injury during a car accident?

May 14, 2022 -

What You Should Know About Dealing With Your Insurance Company After a Car Accident

May 14, 2022 -

Driving tips for teenagers and new drivers

May 14, 2022 -

How are motorcycle accident claims different from car accident claims?

May 14, 2022 -

My protective gear did not prevent an injury during my motorcycle accident, who can I sue?

May 14, 2022 -

Will I have to go to court for my wrongful death case?

May 14, 2022 -

What happens when you file a wrongful death suit in North Carolina?

May 14, 2022 -

What can I do to recover from a catastrophic injury?

May 14, 2022 -

What qualifies as a catastrophic injury in North Carolina?

May 14, 2022 -

Who is responsible for a golf cart accident?

March 12, 2022 -

What is a premises liability policy?

March 12, 2022 -

Can someone sue if they get hurt on your property?

March 12, 2022 -

What is the difference between premises liability and negligence?

March 12, 2022 -

Can I sue after a motorcycle accident?

March 12, 2022 -

What does a truck accident lawyer do?

March 12, 2022 -

Who is liable in a truck accident?

March 12, 2022 -

What do you do after a semi truck accident?

March 12, 2022 -

What you should know about pursuing a wrongful death case.

March 12, 2022 -

What is defensive driving and how will it help me?

March 12, 2022 -

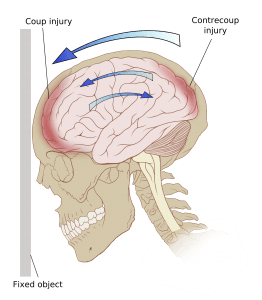

What you should know about whiplash and other head injuries caused by a car accident.

March 12, 2022 -

What do I do if I’m in a car accident with a drunk driver?

March 12, 2022 -

What can car drivers do to avoid accidents with smaller vehicles?

March 12, 2022 -

Seatbelt Safety laws in South Carolina

March 12, 2022 -

I was a pedestrian hit by a car. What do I do next?

March 12, 2022 -

What is a no zone truck accident?

March 12, 2022 -

I was a passenger in a car accident, what do I do?

March 12, 2022 -

What can I do to stay safe while riding a motorcycle?

March 12, 2022 -

5 reasons you should hire a motorcycle accident lawyer

March 12, 2022 -

What actions could be considered distracted driving in North Carolina?

February 2, 2022 -

Injured on Someone Else’s Property? Do I Have a Case?

January 29, 2022 -

Who is responsible for an injury in a premises liability case?

January 29, 2022 -

What is the difference between premises liability and general liability?

January 29, 2022 -

How can I ensure I will be able to cover the cost of my recovery from severe injuries from a motorcycle accident?

January 29, 2022 -

How often are motorcycle accidents fatal?

January 29, 2022 -

What is the number one cause of motorcycle accidents?

January 29, 2022 -

I was a passenger involved in a motorcycle accident. What do I do next?

January 29, 2022 -

How do I know if I qualify for a wrongful death case?

January 29, 2022 -

What Is a Wrongful Death Claim?

January 29, 2022 -

Is It Worth It to Sue After a Car Accident in South Carolina?

January 29, 2022 -

When Should I Get a Lawyer for an Accident?

January 29, 2022 -

What is the average settlement for a car accident in South Carolina?

January 29, 2022 -

Is It Worth Getting a Lawyer for Minor Car Accident in South Carolina?

January 29, 2022 -

How is negligence determined in a South Carolina car accident case?

January 29, 2022 -

Should I have a dashcam in my car in South Carolina?

January 29, 2022 -

What to Do if I Have a Head Injury After a Car Accident in SC?

January 29, 2022 -

What can I do to avoid being in a car accident in inclement weather in South Carolina?

January 29, 2022 -

How do I deal with an aggressive South Carolina driver?

January 29, 2022 -

What actions could be considered distracted driving in South Carolina?

January 29, 2022 -

I was in an accident caused by an uninsured driver in South Carolina. What can I do?

January 29, 2022 -

What happens if I am in a car accident in a work zone in South Carolina?

January 29, 2022 -

What should I do after being in a hit and run accident in South Carolina?

January 29, 2022 -

What Are the Car Insurance Requirements in South Carolina?

January 29, 2022 -

How Can I Protect My Children During a Car Accident in SC?

January 29, 2022 -

What to Do if I Was in an Accident While Driving a Rental Car in SC?

January 29, 2022 -

Why should I go see a doctor after being involved in a South Carolina car accident?

January 29, 2022 -

What are the most common injuries caused by car accidents in South Carolina?

January 28, 2022 -

How is negligence determined in a North Carolina car accident case?

January 28, 2022 -

When should I hire a car accident lawyer?

January 28, 2022 -

What is the average settlement for a car accident in North Carolina?

January 28, 2022 -

Is It Worth Getting a Lawyer for Minor Car Accident in North Carolina?

January 28, 2022 -

Is It Worth It to Sue After a Car Accident in North Carolina?

January 28, 2022 -

Should I have a dashcam in my car in North Carolina?

January 28, 2022 -

What to Do if I Sustained a Severe Head Injury From a Car Accident?

January 28, 2022 -

What can I do to avoid being in a car accident in inclement weather in North Carolina?

January 28, 2022 -

How do I deal with an aggressive North Carolina driver?

January 28, 2022 -

I was in an accident caused by an uninsured driver in North Carolina. What can I do?

January 28, 2022 -

What happens if I am in a car accident in a work zone in North Carolina?

January 28, 2022 -

What should I do after being in a hit and run accident in North Carolina?

January 28, 2022 -

How Do I Protect My Children During a Car Accident in North Carolina?

January 28, 2022 -

What to Do if I Was in an Accident While Driving a Rental Car in NC?

January 28, 2022 -

Why should I go see a doctor after being involved in a North Carolina car accident?

January 28, 2022 -

What are the most common injuries caused by car accidents in North Carolina?

January 28, 2022 -

What to Do After a Car Accident in Charlotte

April 26, 2021 -

How to Get a Police Accident Report in Hartsville, SC

February 19, 2021 -

How to Get a Police Accident Report in Georgetown, SC

February 19, 2021 -

How to Get a Police Accident Report in Laurens, SC

February 19, 2021 -

What Happens if a Medical Condition Causes an Accident?

December 17, 2020 -

How Sleep Apnea Impacts Truck Driving Rates

December 1, 2020 -

What Are Common Cold-Weather Related Injuries?

November 27, 2020 -

How Severe Weather Can Influence Personal Injury Cases

October 9, 2020 -

I Was a Passenger in a Car Accident, What Are My Rights?

August 5, 2020 -

What Are Common Types of Truck Accidents?

February 13, 2020 -

What Is Engine Braking or a Jake Brake?

February 3, 2020 -

What Is a Reefer Trailer?

February 3, 2020 -

What Is a Bobtail Truck?

February 3, 2020 -

What Does GVWR Mean?

February 3, 2020 -

What Are Common Truck Accident Injuries?

January 29, 2020 -

What Is Deadhead Trucking?

January 29, 2020

-

What Is a Subpoena?

January 29, 2020 -

What Is a Commercial Driver’s License?

January 29, 2020 -

What Is a Cab in Trucking?

January 29, 2020 -

Who Is Liable in a Car Accident Case Caused by a Minor?

October 16, 2019 -

How to Get a Police Accident Report in Walhalla, SC

July 15, 2019 -

How to Get a Police Accident Report in Camden, SC

July 15, 2019 -

How to Get a Police Accident Report in Moncks Corner, SC

July 15, 2019 -

How to Get a Police Accident Report in Lexington, SC

July 15, 2019 -

How to Get a Police Accident Report in Irmo, SC

July 15, 2019 -

How to Get a Police Accident Report in Port Royal, SC

July 15, 2019 -

How to Get a Police Accident Report in Gaffney, SC

July 15, 2019 -

How to Get a Police Accident Report in Hardeeville, SC

July 15, 2019 -

How to Get a Police Accident Report in Fountain Inn, SC

July 15, 2019 -

How to Get a Police Accident Report in Hanahan, SC

July 15, 2019 -

How to Get a Police Accident Report in Greer, SC

July 15, 2019 -

How to Get a Police Accident Report in Fort Mill, SC

July 15, 2019 -

How to Get a Police Accident Report in Forest Acres, SC

July 15, 2019 -

How to Get a Police Accident Report in Folly Beach, SC

July 15, 2019 -

How to Get a Police Accident Report in Greenwood, SC

July 15, 2019 -

How to Get a Police Accident Report in Greenville, SC

July 15, 2019 -

How to Get a Police Accident Report in Florence, SC

July 15, 2019 -

How to Get a Police Accident Report in Goose Creek, SC

July 15, 2019 -

How to Get a Police Accident Report in Easley, SC

July 15, 2019 -

How to Get a Police Accident Report in Dillon, SC

July 15, 2019 -

How to Get a Police Accident Report in Denmark, SC

July 15, 2019 -

How to Get a Police Accident Report in Conway, SC

July 15, 2019 -

How to Get a Police Accident Report in Columbia, SC

July 15, 2019 -

How to Get a Police Accident Report in Chester, SC

July 15, 2019 -

How to Get a Police Accident Report in Cheraw, SC

July 15, 2019 -

How to Get a Police Accident Report in Bennettsville, SC

July 15, 2019 -

How to Get a Police Accident Report in Barnwell, SC

July 15, 2019 -

How to Get a Police Accident Report in Bamberg, SC

July 15, 2019 -

How to Get a Police Accident Report in Anderson, SC

July 15, 2019 -

How to Get a Police Accident Report in Allendale, SC

July 15, 2019 -

How to Get a Police Accident Report in Aiken, SC

July 15, 2019 -

How Is Fault Determined in North Carolina Car Accidents?

March 29, 2019 -

What Kind of Information Is in a Police Report?

March 19, 2019 -

What Evidence Should You Collect at a Car Accident Scene?

December 19, 2018 -

How to Get a Police Accident Report in Mount Pleasant, SC

October 31, 2018 -

How to Get a Police Accident Report in Myrtle Beach, SC

October 31, 2018 -

How to Get a Police Accident Report in Summerville, SC

October 31, 2018 -

How to Get a Police Accident Report in Clemson, SC

October 31, 2018 -

How to Get a Police Accident Report in Belton, SC

October 31, 2018 -

How to Get a Police Accident Report in Newberry, SC

October 31, 2018 -

How to Get a Police Accident Report in Spartanburg, SC

October 31, 2018 -

How to Get a Police Accident Report in West Columbia, SC

October 31, 2018 -

How to Get a Police Accident Report in Cayce, SC

October 31, 2018 -

How to Get a Police Accident Report in Beaufort, NC

October 31, 2018 -

How to Get a Police Accident Report in Simpsonville, SC

October 31, 2018 -

How to Get a Police Accident Report in North Myrtle Beach, SC

October 31, 2018 -

How to Get a Police Accident Report in Mauldin, SC

October 31, 2018 -

How to Get a Police Accident Report in Manning, SC

October 31, 2018 -

How to Get a Police Accident Report in Rock Hill, SC

September 5, 2018 -

Who Can Be Held Liable in a Truck Accident?

July 9, 2018 -

How to Get a Police Accident Report in Gastonia, NC

June 19, 2018 -

How to Get a Police Accident Report in Asheville, NC

June 7, 2018 -

What Happens If I’m Injured in an Uber Accident?

June 1, 2018 -

Who Is Responsible When You Are Injured At The Gym?

February 8, 2018 -

What to Do if Your Child Is Hit by a Vehicle?

January 22, 2018 -

What to Do After a Truck Accident?

January 11, 2018 -

How to Read Your North Carolina Traffic Accident Report

November 22, 2017 -

How to Get a Police Accident Report in North and South Carolina

October 12, 2017 -

How to Get a Police Accident Report in Pineville, NC

October 12, 2017 -

How to Get a Police Accident Report in Winston-Salem, NC

October 12, 2017 -

How to Get a Police Accident Report in North Charleston, SC

October 12, 2017 -

How to Get a Police Accident Report in Charleston, SC

October 12, 2017 -

How to Get a Police Accident Report in Durham, NC

October 12, 2017 -

How to Get a Police Accident Report in Greensboro, NC

October 12, 2017 -

How to Get a Police Accident Report in Raleigh, NC

October 12, 2017 -

How to Get a Police Accident Report in Matthews, NC

October 12, 2017 -

What Are Common Delayed Injuries Following an Accident?

September 11, 2017 -

What to Do After a Bike Accident?

September 1, 2017 -

My Dog Bit Someone, What Should I Do?

June 28, 2017 -

What to Do If a Car Hits Your House?

February 3, 2017 -

Who Is Liable in a Rental Car Accident?

December 30, 2016 -

What to Do If a Drunk Driver Flees the Scene?

November 2, 2016 -

What Are Common Causes of Slip and Fall Accidents?

October 7, 2016 -

Can I Sue if I Get Injured at a Haunted House?

October 3, 2016 -

What Are the Most Common Causes of Construction Injuries?

September 28, 2016 -

How Mold Can Lead to Workers’ Compensation

August 24, 2016 -

Does Workers’ Compensation Only Cover Physical Injury?

August 17, 2016 -

What to Do If Your Workers’ Compensation Claim is Denied

August 5, 2016 -

Are Telecommuting Employees Covered by Workers’ Comp?

June 24, 2016 -

Does a Motorcycle Accident Affect My Car Insurance?

June 23, 2016 -

How can a lawyer help me after a motorcycle accident?

June 23, 2016 -

What are the damages from a motorcycle accident?

June 22, 2016 -

What are my rights if I missed time from work due to a motorcycle wreck?

June 22, 2016 -

How do I recover from a motorcycle accident?

June 22, 2016 -

Who is at fault in a motorcycle accident?

June 22, 2016 -

What should I do after a motorcycle accident?

June 22, 2016 -

How can you avoid accidents on a motorcycle?

June 22, 2016 -

What is the most common type of motorcycle accident?

June 22, 2016 -

Motorcycle FAQ Interview with Herb Auger

June 22, 2016 -

What to Do if Your Insurance Claim is Denied?

June 20, 2016 -

How Soon Should I Go Back to Work After an Injury?

May 4, 2016 -

What Are the Most Common Gym Injuries?

April 25, 2016 -

What Are Common Symptoms of Whiplash?

March 18, 2016 -

What Constitutes a Daycare Injury?

February 15, 2016 -

What Are Common Causes of Traumatic Brain Injuries?

January 22, 2016 -

What Are Common Causes of ATV Accidents?

January 20, 2016 -

What Are the Most Common Surgical Errors?

December 21, 2015 -

Is settlement money for a personal injury claim taxable?

December 16, 2015 -

The first time clients call in after they’ve had an accident, what are the most common questions they have?

December 16, 2015 -

How often do your cases end up going to trial?

December 16, 2015 -

What can I do to support or help my claim?

December 16, 2015 -

How does a Car Accident Lawsuit Work?

December 16, 2015 -

How long after a car accident can you make a claim for it?

December 16, 2015 -

How should I report a car accident claim to the insurance company?

December 16, 2015 -

What Should I Do or Not Do After an Accident if I Plan to File an Injury Claim?

December 16, 2015 -

In a 50/50 fault accident, can I get any settlement at all?

December 16, 2015 -

What should I do right after I’ve been in a car accident in North Carolina?

December 16, 2015 -

Can I Be Found Guilty of Contributory Negligence if I’m Not at Fault?

December 16, 2015 -

What is Diabetic Ketoacidosis?

August 21, 2015 -

What Are the Most Common Causes of Car Accidents?

April 29, 2015 -

Common Workplace Injuries

April 29, 2015 -

What Are the Most Common Causes of Motorcycle Accidents?

April 29, 2015 -

How to Get a North Carolina Highway Patrol Accident Report

March 6, 2015 -

How to Get a Police Accident Report in Charlotte, NC

March 6, 2015 -

What Are the Main Types of Product Liability Cases?

March 5, 2015 -

Pedestrian Versus Car: Who Is At Fault?

November 26, 2014 -

What Are the Motorcycle Helmet Laws in North Carolina?

November 6, 2014 -

What to Do after a Car Accident

October 31, 2014 -

How to Sue a Drunk Driver

October 29, 2014 -

How An Automobile Accident Attorney In Nc Can Help

October 29, 2013 -

What To Do If You Are Seriously Injured

October 29, 2013 -

North Carolina Auto Accident Faq

October 29, 2013 -

North Carolina Workers Compensation Faq

October 29, 2013 -

What Is Personal Injury Law?

October 29, 2013 -

What Is the Process of Auto Accident Litigation?

October 29, 2013 -

Who Is Responsible for Medical Bills After a Car Accident?

October 29, 2013 -

How a Lawyer Can Help With Medical Treatment Bills

October 29, 2013 -

How to Deal With an Insurance Company After an Injury?

October 29, 2013

When you are injured due to someone else’s actions, there are likely a thousand questions running through your mind. These may range from, “How long will it take to fully heal?” to, “How do I file a lawsuit against the person who hurt me?” While an experienced injury attorney can answer all of these questions, asking them all during your initial free consultation can take up valuable time. That’s why we have compiled a list of frequently asked questions for common injuries.

Your injury may be from a dog bite, car crash, workplace accident or other incident. The more informed you are about these situations, the quicker you and your attorney can move forward and begin the process of filing a lawsuit. Of course, when you speak with an attorney, you are free to ask any question to clear up any confusion about your injury or the legal process that comes next; that’s why your lawyer is there. The better we can clear up any confusion you have, the more effective we can be in helping you.

Below you will find links to frequently asked questions about different kinds of personal injury in North Carolina. If your question is not answered, or you need legal assistance in seeking compensation for your injury, contact Auger & Auger Accident and Injury Lawyers today to learn more about how we can help you. Your initial consultation is free, during which we will review all the details of your case and advise you on the best course of action.

Auto Accident FAQ

Getting in a car accident and dealing with the aftermath can be a confusing situation. Who is at fault? What should you tell the insurance company? These questions and more are answered on our auto accident FAQ page, as well as in this interview with Herb Auger.

Truck Accident FAQ

Truck accidents are some of the most serious on North Carolina’s roads. You may be seriously injured, leading to drastic consequences in your personal life. Learn more about truck accidents on the FAQ page.

Workers’ Compensation FAQ

When you are injured at work, workers’ compensation is supposed to cover your medical bills and other expenses. However, the process doesn’t always work right. Visit our workers’ comp FAQ page to learn more.

Xarelto Lawsuit FAQ

The blood thinner Xarelto can be a useful drug, but it can also be highly dangerous. If you’ve suffered pain or injury while on Xarelto, you may be confused about your legal options. This FAQ page should clear some things up.

Motorcycle Accident FAQ

Taking the motorcycle out for a spin is a great way to spend an afternoon, but it can also result in disaster. Motorcycle accidents often lead to serious injury and other consequences. Learn more about your legal options with this FAQ interview.

Dog Bite FAQ

Being bitten by a dog can have long-term effects. Not only could you deal with scarring and disfigurement, but may also face disease and infection. Learn more about what to do after being bitten by a dog in this FAQ interview.